401k Max Compensation 2024. 401(k) employee contribution limits increase in 2024 to $23,000 from $22,500 in 2023. There are also some reasons you may.

In 2024, employers and employees together can. In 2024, the irs allows you to contribute up to $23,000 to your 401(k) plan, up from $22,500 in 2023.

The 401(K) Contribution Limit For 2024 Is $23,000.

The contribution limit for 401 (k)s, 403 (b)s, most 457 plans and the federal government's thrift savings plan is $23,000 for 2024, up from $22,500 in 2023.

Glass Lewis Also Recommended Boeing Shareholders Vote To Approve Top Executives' 2023 Compensation, Under Which Ceo Calhoun's Pay Package Rose About.

Those 50 and older can contribute an additional $7,500.

Employers Can Contribute To Employee.

Images References :

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), Those 50 and older can contribute an additional $7,500. The 401(k) compensation limit is $345,000.

Source: www.gobankingrates.com

Source: www.gobankingrates.com

What Are the Maximum 401(k) Contribution Limits? GOBankingRates, The irs revisits these numbers annually and, if necessary, adjusts them for inflation. That's crucial info for participants in nonqualified deferred comp (nqdc) plans.

Source: sheetsforinvestors.com

Source: sheetsforinvestors.com

Free 401(k) Calculator Google Sheets and Excel Template, For 2024, the 401(k) limit for employee salary deferrals is $23,000, which is above the 2023 401(k) limit of $22,500. Total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

401k Maximum Contribution Limit Finally Increases For 2019, Employers can contribute to employee. Certain plans subject to department of labor rules, such as 401(k) plans,.

Source: clementinewbrynn.pages.dev

Source: clementinewbrynn.pages.dev

2024 Charitable Contribution Limits Irs Linea Petunia, The irs just released the 2024 contribution limits on qualified 401(k) plans. Of note, the 2024 pretax limit that applies to elective deferrals to irc section 401(k), 403(b) and 457(b) plans increased from $22,500 to $23,000.

Source: www.procalculator.com

Source: www.procalculator.com

401k Calculator Calculators For All Mobile Friendly, That's crucial info for participants in nonqualified deferred comp (nqdc) plans. As of 2023, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a.

:max_bytes(150000):strip_icc()/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

What Is a Safe Harbor 401(k)?, If you claim the standard deduction of $14,600 for your 2024 tax return, your taxable income for the year would be $115,400. Employer matches don’t count toward this limit.

Source: rositawcarena.pages.dev

Source: rositawcarena.pages.dev

Federal 401k Contribution Limit 2024 Gaby Pansie, Employees can contribute up to $23,000 to their 401(k) plan for 2024 vs. The 2024 401(k) individual contribution limit is $23,000, up from $22,500 in 2023.

Source: isabellewaddy.pages.dev

Source: isabellewaddy.pages.dev

2024 Max Employee 401k Contribution Cari Marsha, You can do so after you turn 59 ½ (before that, you’ll have to pay an early. Total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2024.

Source: www.midlandsb.com

Source: www.midlandsb.com

Plan Sponsor Update 2023 Retirement Plan Limits Midland States Bank, For 2024, the 401(k) limit for employee salary deferrals is $23,000, which is above the 2023 401(k) limit of $22,500. Total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2024.

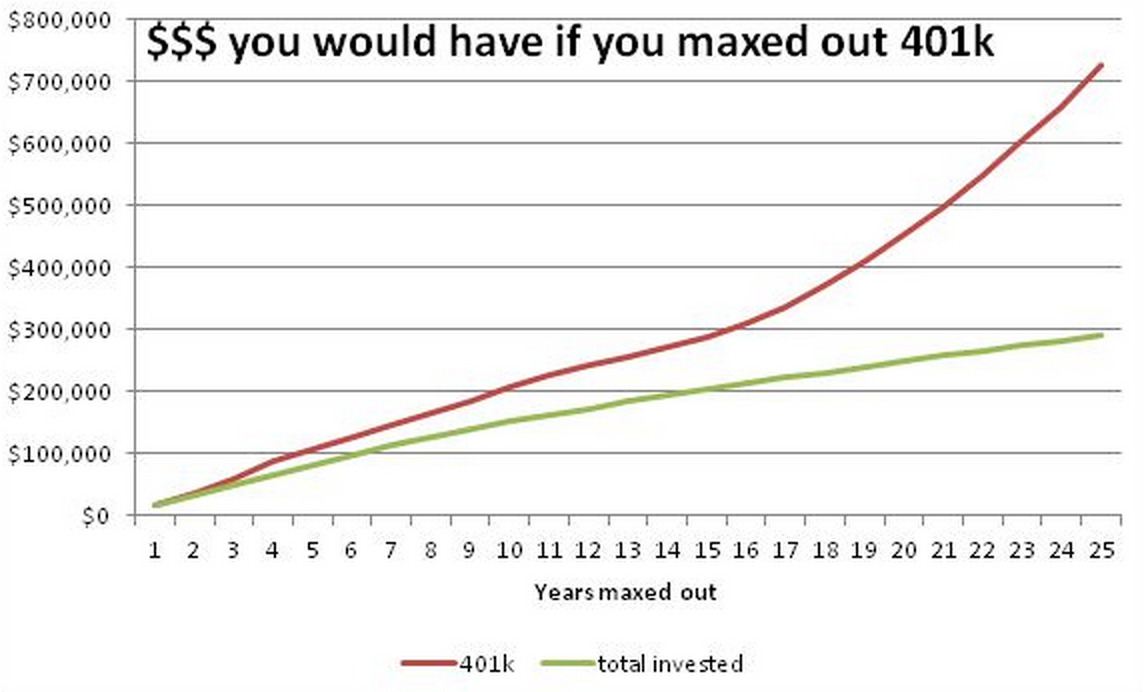

Maxing Out Your 401(K) Can Improve Your Retirement Readiness Significantly.

What is the 401(k) contribution limit in 2024?

There Are Also Some Reasons You May.

Participants can contribute up to $23,000 to their 401(k) plans in 2024 (up from $22,500 in 2023).